At Closing on 27-Dec-2011

KLCI Index : 1500.91

P/E Ratio : 16.1198

An Average-Income Earner's determined choice to be Financially Free through Intelligent Investments in Properties, Shares, ETFs, Options and Businesses.

Tuesday, December 27, 2011

Monday, December 26, 2011

KLSE FTSE Bursa Malaysia KLCI P/E as at 23-Dec-2011

At Closing on 23-Dec-2011

KLCI Index : 1496.15

P/E Ratio : 16.0687

KLCI Index : 1496.15

P/E Ratio : 16.0687

Thursday, December 22, 2011

KLSE FTSE Bursa Malaysia KLCI P/E as at 22-Dec-2011

At Closing on 22-Dec-2011

KLCI Index : 1491.46

P/E Ratio : 16.0183

KLCI Index : 1491.46

P/E Ratio : 16.0183

KLSE FTSE Bursa Malaysia KLCI P/E as at 21-Dec-2011

At Closing on 21-Dec-2011

KLCI Index : 1484.98

P/E Ratio : 15.9488

KLCI Index : 1484.98

P/E Ratio : 15.9488

KLSE FTSE Bursa Malaysia KLCI P/E as at 20-Dec-2011

At Closing on 20-Dec-2011

KLCI Index : 1465.17

P/E Ratio : 15.736

KLCI Index : 1465.17

P/E Ratio : 15.736

Tuesday, December 20, 2011

A very blissful time off day

It has been a week since I left the Away Message on my work email outlook. I'm feeling terrific. No signs of lethargy or shoulder pain. I feel at ease, no, better.. I feel alive, very alive.

I'm poking this entry on my mobile blogger while sipping a long black with jazz playing in the background at a quaint coffee shop. I am feeling such pleasure that I just have to stop reading my book and whip out my phone to pen this moment.

This is how I want to live. With a choice. Freedom to execute my day in the way I want it to be. To be untrapped. To really live.

I'm poking this entry on my mobile blogger while sipping a long black with jazz playing in the background at a quaint coffee shop. I am feeling such pleasure that I just have to stop reading my book and whip out my phone to pen this moment.

This is how I want to live. With a choice. Freedom to execute my day in the way I want it to be. To be untrapped. To really live.

FBM KLCI Market PE as at 19 Dec 2011

At Closing on 19 Dec 2011

KLCI Index : 1477.78

KLCI PE : 15.9346

KLCI Index : 1477.78

KLCI PE : 15.9346

Saturday, December 17, 2011

Thursday, December 15, 2011

Wednesday, December 14, 2011

Year end break

I'll be taking a short family vacation from today till next Thursday. KLCI PE Ratio Daily updates will be published as usual if there is Internet connection available.

The story on petronas Dagangan will have to wait while I get some sun, sea and sand.

The story on petronas Dagangan will have to wait while I get some sun, sea and sand.

Tuesday, December 13, 2011

KLSE FBM KLCI PE Ratio as at 13-Dec-2011

At Closing on 13-Dec-2011

KLCI Index : 1465.39

P/E Ratio : 16.0055

KLCI Index : 1465.39

P/E Ratio : 16.0055

Monday, December 12, 2011

FTSE Bursa Malaysia (KLSE) KLCI 10-year P/E Multiple Chart as at 2-Dec-2011

KLSE FTSE Bursa Malaysia P/E as at 12-Dec-2011

At Closing on 12-Dec-2011

KLCI Index : 1467.1

P/E Ratio : 16.025

KLCI Index : 1467.1

P/E Ratio : 16.025

Sunday, December 11, 2011

Seminar: Creating Multiple Sources Of Income

How To Prepare For The

Coming Economic Downturn With Multiple Sources Of Income

I attended the above

titled seminar 2 Thursdays ago on 1st December 2011. The seminar starts at

7:45pm and I have been stuck in a horrific traffic jam for the past 1 1/2 hour,

despite leaving work on the dot. I have never driven to Armada Hotel before,

where the seminar is held, and I am attending it alone. Tough to get someone to

accompany me as most just want to get home and get comfy after work. To attend

a seminar on making multiple sources of income is too stressful. But I was

determined to explore any opportunity that could give me a boost towards

financial freedom.

At 7:30pm, I've arrived at

the seminar venue. The turn-up was good. Mostly young adults, with a scatter of

younger grads and older folks.

The presentor is KC See,

master coach and mentor of the 14 year running Money Mastery Program. I didn't

know who he was. But one thing that immediately caught my interest was that he

learned his stuff from Robert Kiyosaki, DIRECTLY, the man himself. KC See

followed Kiyosaki around for 2 years before setting out on his own. Okay, KC

had a great mentor, better perk up and listen to what he has to say.

If you are interested in

attending this seminar, register by Email to receive your free invitation. Send

your name, mobile number and no. of seat to dctbff@gmail.com

Here are the topics he

covered in the seminar. Some words are his, some are my own thoughts.

1. Revisiting your money

concepts and beliefs-foundations of money making habits.

What is wealth?

Common answers include

'When I'm a millionaire', 'When I own big cars and big houses', 'When I earn

atleast a 5-figure income monthly salary'

Robert Kiyosaki's

defination of wealth:- 'The number of days you can survive forward, maintaining

your current lifestyle, if you quit your job tomorrow'

You are truly wealth when

your answer is FOREVER. Which means you do not need to work if you so wish and

still be able to maintain your lifestyle indefinately because you have multiple

sources of income that churns out money for you.

Our beliefs-foundation of

money making is deeply inculcated in us since young. If your parents believe

that Money is the Root is all Evil, their belief will rub off you. Other

believes include, More money = more stress, less time.

2. Why most people wants Multiple Sources

of Income (MSI) and why most FAIL.

Why most people wants

Multiple Sources of Income is rather apparent right?

We want more money! Okay

there are other reasons too.

Recession risk that looms.

Jobs may be cut. If we do not rely on just ONE source of income, our salary,

but we have multiple sources of income, then losing just one income stream when

we get retrenched will not have much devastating impact.

For me, I want to leave my

9-6 job and still have a substantial income to support my family. To achieve

that, I must start building multiple sources of income now. By the time my

other sources of income surpass my salary, I can call it quit!

Now, the reality. Most

FAIL. Why?

This is actually covered

in the invitation sent out. So I'm just gonna do a cut-n-paste job here.

Fact 1

IN a recent survey of close to 896 people like yourself, we

found that 91.36% of people agree that they should have MSI. However only 23.4

% actually get it done. Why? Intentions are always there but nothing really

matters until you take action. Many just could not get started.

Fact 2

A large number of people who embark on their MSI, went into

income ideas that either does not suit them or does not produce the results

they want. They make wrong choices. They have no guidelines or criteria to help

them make the right decisions. They just listen to their friends and join them.

But what suits their friends does not necessarily suits them.

Fact 3

Some has great ideas but has no template or the necessary

resources or support to help them make it into a real-world income. They end up

frustrated and disenchanted.

Fact 4

Some went to into what seems to be MSI and end up losing money

and losing time.

3. 4 decisions people make in order to

change their financial results.

1st Decision

Must Create Multiple

Source of income

Having ONE source of

income, for most people, their salary, is extremely RISKY.

If your job can be

replaced by a machine or someone else who is willing to take a lower salary, be

very worried.

Even a high-flying career

is threatened when the global economy declines. Something not within our

control. The entire division may be shut down to cut cost. Bond traders

specializing in dried up markets such as Greece

and Italy

find themselves out of job very fast.

Anyone with single income

is at risk. So, we must create multiple source of income. It’s not a

nice-to-have, but a MUST.

2nd Decision

Decide to Make a Change.

Reeducate yourself.

The only thing certain in

life is CHANGE. Change BEFORE you need to. Embrace change with continuous

learning.

3rd Decision

Leverage

R.I.C.E -four (4) building

blocks to income generation.

Leverage is a very

powerful tool to boost our returns. RICE are the factors that we can leverage

on

R- Resources. Time and/or

Money.

I – Ideas

C – Contacts

E – Expertise

This answers to excuses that

we come up with for not having a second income. No time! No money! Don’t know

what to do! No contacts! Don’t know how to do!

We don’t have to do

everything ourselves. LEVERAGE!

4th Decision

Rediscover True Passion

“Find the job you love,

and you will never work a day in your life”

‘Nuff said.

We need to have two types

of income; PASSIVE & PASSION income. Passive income generates money for us

so that we may pursue our passion income. Passion income is something we love

doing so much that we’ll do it even if it pays us nothing. But more often than

not, our passion income produces great results because of our drive and

enthusiasm.

5. What do we need?

1. Community

2. System

3. Mentor/coach

4. Continuous Learning

5. Mastermind Group

6. RICE

7. Regional Support

Take-home points

Most people want

side-income. Or multiple source of income. But most of us do not have them.

Why? Because we never took action to pursue them. Why? 2 top excuses, NO TIME

and NO MONEY. They are really excuses, not valid reasons.

Because,

#1 Everyone

has the same number of hours in a day.

#2 The richest people in the world start

with little money. It's often the lack of money that drives them, not the other

way round.

There are many ways to

build multiple source of income. We don't have to be rich, have a lot of time

or have high education.

If you had read Robert

Kiyosaki's books, you are probably convinced that working hard as an employee

is not the way to go and you need to build your income from the Business and

Investment Quadrants. I read Kiyosaki's books and I understand, but I DON'T

KNOW how to execute the concepts. KC See's Money Mastery course is a practical

hands-on program whereby we are coached on how to execute and build these

multiple sources of income. I find this bit particularly useful because it's

not just about changing your mindset, beliefs, goal setting, etc etc which all

translate into INTENTION. Intention gets us nowhere unless action is taken. The

coaching will whip us up and ensure that we convert our intention into action.

Coaching is up to 2-year by the way. Sufficient to guide us to stand on our

own.

If you are interested in

attending this seminar, register by Email to receive your free invitation. Send

your name, mobile number and no. of seat to dctbff@gmail.com

Next seminar is on 5th

January 2012 (Thursday), 7:45PM at Hilton Hotel, Petaling Jaya.

I’ll update on seminar

schedule and other seminars that they have on this blog.

KLSE FTSE Bursa Malaysia P/E as at 09-Dec-2011

At Closing on 09-Dec-2011

KLCI Index : 1460.13

P/E Ratio : 15.949

KLCI Index : 1460.13

P/E Ratio : 15.949

Thursday, December 8, 2011

KLSE FTSE Bursa Malaysia P/E on 08-Dec-2011

At Closing on 08-Dec-2011

KLCI Index : 1472.92

P/E Ratio : 16.0874

KLCI Index : 1472.92

P/E Ratio : 16.0874

Quick Chat 9-Dec-2011

I have been deliberating over the next stock to cover. So far I've written on Carlsberg and Guinness Anchor Bhd. Both breweries. I really want to get the scoop on Dutch Lady, a stock that I've been eyeing on for almost a year now, but covering yet another consumer defensive stock is kinda boring. So I've decided to do Petronas Dagangan instead. I hope to get the first part up next week.

Current Market Perspective

EU Summit is still on-going but bad news have been leaking out like a bad tap. ECB has reiterated that it will not buy European gov bonds indefinitely. Germany says no to turning ESFS into a banking facility.

It doesn't look like there will be a Santa rally this year end. But then, the market will find a reason if it wants it to happen, even if it is just thin hope.

My Long Views

Europe will dip into recession in 2012 and US will follow suit. We will not be spared here.

Current Market Perspective

EU Summit is still on-going but bad news have been leaking out like a bad tap. ECB has reiterated that it will not buy European gov bonds indefinitely. Germany says no to turning ESFS into a banking facility.

It doesn't look like there will be a Santa rally this year end. But then, the market will find a reason if it wants it to happen, even if it is just thin hope.

My Long Views

Europe will dip into recession in 2012 and US will follow suit. We will not be spared here.

KLSE FTSE Bursa Malaysia P/E on 07-Dec-2011

At Closing on 07-Dec-2011

KLCI Index : 1482.99

P/E Ratio : 16.1969

KLCI Index : 1482.99

P/E Ratio : 16.1969

Wednesday, December 7, 2011

KLSE FTSE Bursa Malaysia P/E on 06-Dec-2011

At Closing on 06-Dec-2011

KLCI Index : 1480.92

P/E Ratio : 16.1732

KLCI Index : 1480.92

P/E Ratio : 16.1732

Tuesday, December 6, 2011

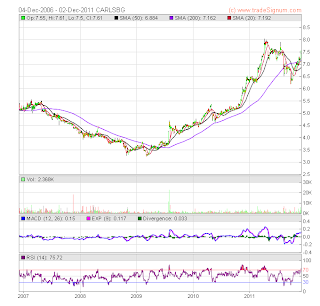

Carlsberg Brewery Malaysia Bhd – Technical Analysis

Trend

Both Long & Short Term Trend is in an Uptrend

Simple Moving Average & MACD & Parabolic SAR

Price is above its 20-Day, 50-Day and 200-Day average,

bullish. 20-Day SMA has crossed 50-Day

SMA.

MACD is also giving bullish signals; blue line crossing the

signal(red) line, both lines are above the 0-mark. MACD bar is green and MACD

line hooking up.

Price is above Parabolic Stop & Reversal, bullish.

Support & Resistance

At 7.61, Carlsberg is trading close to its immediate

resistance line at 7.64. Breaking above this, it may go up to 7.93, a strong

resistance near 52-week high.

Immediate support is at 7.18.

Volume for the past few trading sessions is looking very

healthy too.

Monday, December 5, 2011

KLSE FTSE Bursa Malaysia P/E on 05-Dec-2011

At Closing on 05-Dec-2011

KLCI Index : 1489.95

P/E Ratio : 16.2721

KLCI Index : 1489.95

P/E Ratio : 16.2721

Sunday, December 4, 2011

Carlsberg - Fundamental Analysis

In Carlsberg, The Story ,Carlsberg Brewery Berhad appears to have a more exciting outlook than Guinness Anchor Berhad. Let's see if the figures support the story.

EPS & Revenue Growth

From the divergence of the EPS and Revenue chart lines, we can see that the profit margin of Carlsberg is being squeezed prior to 2009.

Both revenue and profit increased tremendously after the acquisition of Carlsberg Singapore in 2009.

Financial year end of Carlsberg Bhd is 31 Dec.

This is how it has performed this year, 2011.

Q1 Q2 Q3

Revenue 407215 345512 4101661

EPS 16.01 10.15 15.98

EPS for 3 cumulative quarters sums up to 42.14, almost reaching the EPS of Year 2010. Achieving 20% growth in 2011 is at hand.

Gross profit margin in 2010 is 34%, compared to GAB 31%.

ROE at 23% is a big improvement over the previous 8 years of under 20% return on equity.

Carlsberg doesn't have to spend big on Capex, 23mill in 2010. Depreciation is a single digit %.

Free Cash Flow yield (FCF) at 8% is outstanding.

Retained earnings is also building up

2006 2007 2008 2009 2010

323.3 319.1 316.0 363.5 438.2

Gearing

Carlsberg has no long term debt. It has some short term debts tho.

DE ratio 0.6.

At time of writing, 1-Dec-2011,

PE : 17.13

PEG: 1.47

Compared to GAB (I'm using GAB instead of the industry because there are only 2 players!), having PE 18 and PEG >2, Carlsberg share price bodes better with me.

DCF computes a fair value of 8.18 for Carlsberg.

Without thorough analysis of these 2 breweries, I'd have gone for GAB due to personal preference for its beer. Now, I lean towards Carlsberg if I have to choose just one to buy.

EPS & Revenue Growth

From the divergence of the EPS and Revenue chart lines, we can see that the profit margin of Carlsberg is being squeezed prior to 2009.

Both revenue and profit increased tremendously after the acquisition of Carlsberg Singapore in 2009.

Financial year end of Carlsberg Bhd is 31 Dec.

This is how it has performed this year, 2011.

Q1 Q2 Q3

Revenue 407215 345512 4101661

EPS 16.01 10.15 15.98

EPS for 3 cumulative quarters sums up to 42.14, almost reaching the EPS of Year 2010. Achieving 20% growth in 2011 is at hand.

Gross profit margin in 2010 is 34%, compared to GAB 31%.

ROE at 23% is a big improvement over the previous 8 years of under 20% return on equity.

Carlsberg doesn't have to spend big on Capex, 23mill in 2010. Depreciation is a single digit %.

Free Cash Flow yield (FCF) at 8% is outstanding.

Retained earnings is also building up

2006 2007 2008 2009 2010

323.3 319.1 316.0 363.5 438.2

Gearing

Carlsberg has no long term debt. It has some short term debts tho.

DE ratio 0.6.

At time of writing, 1-Dec-2011,

PE : 17.13

PEG: 1.47

Compared to GAB (I'm using GAB instead of the industry because there are only 2 players!), having PE 18 and PEG >2, Carlsberg share price bodes better with me.

DCF computes a fair value of 8.18 for Carlsberg.

Without thorough analysis of these 2 breweries, I'd have gone for GAB due to personal preference for its beer. Now, I lean towards Carlsberg if I have to choose just one to buy.

KLSE FTSE Bursa Malaysia P/E on 02-Dec-2011

At Closing on 02-Dec-2011

KLCI Index : 1489.02

P/E Ratio : 16.2617

KLCI Index : 1489.02

P/E Ratio : 16.2617

Thursday, December 1, 2011

Carlsberg, The Story

There are only 3 listed companies under the sub-sector of Breweries in KLSE/Bursa Malaysia. Guinness Anchor, Carlsberg and the third is a distributor of wine. Napex, which brews Jazz and Starker(served at the very popular Overtime chain of pubs) is not listed.

Since I have covered Guinness Anchor Berhad (GAB) here, here and here, I might as well do it for its strongest competitor. Yea, That Calls for a Carlsberg.

Carlsberg Breweries Berhad is a direct competitor of Guinness Anchor Berhad, for it does the same thing. Brews, markets and distributes beer,stout and shandy. Its product line up is more extensive compared to GAB, which has 10 brands. Carlsberg has more than double.

Beer Brewed Locally

Carlsberg

Skol

Tuborg (Premium Beer)

Stout Brewed Locally

Danish Royal Stout

Connor's (Premium Stout)

Super Premium Beer

Kronenbourg 1664

Imported Beer

Corona

Tetleys

Non-alchoholic Produced Locally

Nutrimalt

Jolly Shandy

By subsidiary

Luen Heng F&B Sdn Bhd

Becks

Budweiser

Crown Lager

Foster's

Franziskaner

Hoegaarden

Lowen Brau

Pure Blonde

Victoria Bitter

Warsteiner

Stella Artois

Leffe

Erdinger

Asahi

By Joint Controlled Entity

Cottingham & Co Ltd (Taiwan)

Beers, spirits, and alcoholic beverage

Beers include lagers, ales, dark beers, wheat beers and stouts.

Brands are Carlsberg,Corona Extra, Erdinger, Guinness, Kronenbourg 1664 and Tetley's

Also distributes Glenfarclas single malt Scotch whisky

By Associate Entity

Lion Brewery (Ceylon) in Sri Lanka

Lion Lager, Carlsberg, Strong Beer, Special Brew and Lion Stout.

Carlsberg Malaysia has presense in countries outside Malaysia unlike GAB which only operates in Malaysia.

Wholly owned subsidiaries of Carlsberg Malaysia are Carlsberg Marketing Sdn Bhd & Carlsberg Singapore Pte Ltd.

Carlsberg Msia has a 70% stake in Luen Heng F&B Sdn Bhd.

Carlsberg Malaysia makes its presense in Taiwan via jointly controlled Entities, Carlsberg Distributors Taiwan Limited ('CDTL') 50% and Carlsberg Cottingham 75%. In Sri Lanka, Carlsberg Malaysia has an investment of 24.6% in Lion Brewery (Ceylon) PLC.

How do these entities contribute to Carlsberg Malaysia Bhd's bottom line?

Operations in Malaysia contributes to 71% of profit. Singapore 29%. And others made a loss of 2 million in 2010.

In term of revenue, Malaysia contributes 76%, Singapore 23% and others 1%.

My discussion hereafter will focus on Carlsberg Malaysia and Singapore.

Mainstream beer accounts for 80% of its revenue. Premium beer, 10% of revenue, will be the segment targetted for growth. 3 years ago, Carlsberg has less than 5% market share in the premium beer segment. Now, Hoegaarden and Kronenbourg have a market share of 20% in premium beer market. MD Soren Ravn expects its premium beers to account for 40% of revenue within the next 3-5 years once Carlsberg starts brewing them in-house. The plan is to brew 2 premium brands in 2012. My guess is Hoegaarden and Kronenbourg. Makes better sense right?

How does brewing premium beer in-house translate into higher earnings?

First, Carlsberg saves on logistics costs. Second, it enjoys an exemption of RM5 per litre on import duty.

By the way, GAB brews Kilkenny locally.

In Oct 2009, Carlsberg Berhad acquired Carlsberg Singapore for 370 million. Carlsberg Singapore has 20% share of the beer and stout market in Singapore. It is at second position after market leader Asia Pacific Breweries (APB) that commands 63% market share. Tiger rocks Singapore. Annual beer consumption per person is 20 litres which is surprisingly the same as Malaysia. I had the impression that Singaporeans party harder and thus guzzle more beer.

The million dollar question... Can Carlsberg Singapore wrestle away some market share from APB? It has doubled its market share from 10% in the 1990s to 20% currently. Garnering more market share is an uphill battle due to strong branding of Tiger in Singapore. Let's just assume Carlsberg Singapore maintains its market share of 20%, Carlsberg Bhd still enjoys some upside of synergy in marketing and better utilization of capacity at its Shah Alam brewery. I'll be keeping an eye on Carlsberg Singapore growth.

Dividend and share price

Carlsberg is a dividend stock. Dividend payout took a beating in 2008 and 2009 due to the acquisition of Carlsberg Singapore, draining its coffers dry. Last year, 2010, gross dividend yield was 4%. And this year, total of 0.555 of dividend has been distributed. Gross yield of 7% at current market price of 7.25. Welcome back to the dividend camp Carlsberg.

CAGR of Carlsberg from 2007-2011 is 14.35%. A little lower than GAB at 19%. But still a fantastic return none the less.The trend of Carlsberg's stock price is somewhat similiar to GAB. Resilient and rising steadily.

Major event in 2012 is the UEFA European Cup, of which the group is the official sponsor. Drink up people.

Like GAB, Carlsberg also faces the problem of increasing costs of raw material, mainly malt which accounts for 30% of total raw material costs. Carlsberg counters by hedging up to 85% of its 2012 malt requirements.

Brewers escaped an excise hike in Budget 2011. But there is still a risk of off-budget duty hike.

However, Carlsberg has been able to pass costs to consumer. A raise of 3-5% in price may happen in year 2012 and is likely not to affect sales.

In Summary

The story on Carlsberg is a tad more interesting than Guinness. Carlsberg sells a wide range of beer. It makes sure there is beer for every segment of consumer out there. Carlsberg has also more potential to increase its profit. First, its plan to brew 2 premium beer in-house. Second, at 20% market share, Carlsberg Singapore has room to grow. In the stout segment, we can forget about Royal Stout. Stout here goes unanimously with Guinness. I favor the story on Carlsberg as there is more to look forward to.

Since I have covered Guinness Anchor Berhad (GAB) here, here and here, I might as well do it for its strongest competitor. Yea, That Calls for a Carlsberg.

Carlsberg Breweries Berhad is a direct competitor of Guinness Anchor Berhad, for it does the same thing. Brews, markets and distributes beer,stout and shandy. Its product line up is more extensive compared to GAB, which has 10 brands. Carlsberg has more than double.

Beer Brewed Locally

Carlsberg

Skol

Tuborg (Premium Beer)

Stout Brewed Locally

Danish Royal Stout

Connor's (Premium Stout)

Super Premium Beer

Kronenbourg 1664

Imported Beer

Corona

Tetleys

Non-alchoholic Produced Locally

Nutrimalt

Jolly Shandy

By subsidiary

Luen Heng F&B Sdn Bhd

Becks

Budweiser

Crown Lager

Foster's

Franziskaner

Hoegaarden

Lowen Brau

Pure Blonde

Victoria Bitter

Warsteiner

Stella Artois

Leffe

Erdinger

Asahi

By Joint Controlled Entity

Cottingham & Co Ltd (Taiwan)

Beers, spirits, and alcoholic beverage

Beers include lagers, ales, dark beers, wheat beers and stouts.

Brands are Carlsberg,Corona Extra, Erdinger, Guinness, Kronenbourg 1664 and Tetley's

Also distributes Glenfarclas single malt Scotch whisky

By Associate Entity

Lion Brewery (Ceylon) in Sri Lanka

Lion Lager, Carlsberg, Strong Beer, Special Brew and Lion Stout.

Carlsberg Malaysia has presense in countries outside Malaysia unlike GAB which only operates in Malaysia.

Wholly owned subsidiaries of Carlsberg Malaysia are Carlsberg Marketing Sdn Bhd & Carlsberg Singapore Pte Ltd.

Carlsberg Msia has a 70% stake in Luen Heng F&B Sdn Bhd.

Carlsberg Malaysia makes its presense in Taiwan via jointly controlled Entities, Carlsberg Distributors Taiwan Limited ('CDTL') 50% and Carlsberg Cottingham 75%. In Sri Lanka, Carlsberg Malaysia has an investment of 24.6% in Lion Brewery (Ceylon) PLC.

How do these entities contribute to Carlsberg Malaysia Bhd's bottom line?

Operations in Malaysia contributes to 71% of profit. Singapore 29%. And others made a loss of 2 million in 2010.

In term of revenue, Malaysia contributes 76%, Singapore 23% and others 1%.

My discussion hereafter will focus on Carlsberg Malaysia and Singapore.

Mainstream beer accounts for 80% of its revenue. Premium beer, 10% of revenue, will be the segment targetted for growth. 3 years ago, Carlsberg has less than 5% market share in the premium beer segment. Now, Hoegaarden and Kronenbourg have a market share of 20% in premium beer market. MD Soren Ravn expects its premium beers to account for 40% of revenue within the next 3-5 years once Carlsberg starts brewing them in-house. The plan is to brew 2 premium brands in 2012. My guess is Hoegaarden and Kronenbourg. Makes better sense right?

How does brewing premium beer in-house translate into higher earnings?

First, Carlsberg saves on logistics costs. Second, it enjoys an exemption of RM5 per litre on import duty.

By the way, GAB brews Kilkenny locally.

In Oct 2009, Carlsberg Berhad acquired Carlsberg Singapore for 370 million. Carlsberg Singapore has 20% share of the beer and stout market in Singapore. It is at second position after market leader Asia Pacific Breweries (APB) that commands 63% market share. Tiger rocks Singapore. Annual beer consumption per person is 20 litres which is surprisingly the same as Malaysia. I had the impression that Singaporeans party harder and thus guzzle more beer.

The million dollar question... Can Carlsberg Singapore wrestle away some market share from APB? It has doubled its market share from 10% in the 1990s to 20% currently. Garnering more market share is an uphill battle due to strong branding of Tiger in Singapore. Let's just assume Carlsberg Singapore maintains its market share of 20%, Carlsberg Bhd still enjoys some upside of synergy in marketing and better utilization of capacity at its Shah Alam brewery. I'll be keeping an eye on Carlsberg Singapore growth.

Dividend and share price

Carlsberg is a dividend stock. Dividend payout took a beating in 2008 and 2009 due to the acquisition of Carlsberg Singapore, draining its coffers dry. Last year, 2010, gross dividend yield was 4%. And this year, total of 0.555 of dividend has been distributed. Gross yield of 7% at current market price of 7.25. Welcome back to the dividend camp Carlsberg.

CAGR of Carlsberg from 2007-2011 is 14.35%. A little lower than GAB at 19%. But still a fantastic return none the less.The trend of Carlsberg's stock price is somewhat similiar to GAB. Resilient and rising steadily.

Major event in 2012 is the UEFA European Cup, of which the group is the official sponsor. Drink up people.

Like GAB, Carlsberg also faces the problem of increasing costs of raw material, mainly malt which accounts for 30% of total raw material costs. Carlsberg counters by hedging up to 85% of its 2012 malt requirements.

Brewers escaped an excise hike in Budget 2011. But there is still a risk of off-budget duty hike.

However, Carlsberg has been able to pass costs to consumer. A raise of 3-5% in price may happen in year 2012 and is likely not to affect sales.

In Summary

The story on Carlsberg is a tad more interesting than Guinness. Carlsberg sells a wide range of beer. It makes sure there is beer for every segment of consumer out there. Carlsberg has also more potential to increase its profit. First, its plan to brew 2 premium beer in-house. Second, at 20% market share, Carlsberg Singapore has room to grow. In the stout segment, we can forget about Royal Stout. Stout here goes unanimously with Guinness. I favor the story on Carlsberg as there is more to look forward to.

Labels:

Carlsberg,

Fundamental Analysis,

KLSE,

Stock Picking,

The Story

KLSE FTSE Bursa Malaysia P/E on 01-Dec-2011

At Closing on 01-Dec-2011

KLCI Index : 1485.26

P/E Ratio : 16.2138

KLCI Index : 1485.26

P/E Ratio : 16.2138

Subscribe to:

Posts (Atom)