An Average-Income Earner's determined choice to be Financially Free through Intelligent Investments in Properties, Shares, ETFs, Options and Businesses.

Sunday, February 19, 2012

Monday, February 13, 2012

KLSE 10 Year PE Ratio Graph as at 3 Feb 2012

Source:Public Mutual

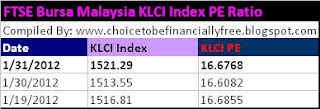

Please note that P/E here of 15.3x is based on FORWARD/Forecast PE on 2012 earnings. For actual PE, please refer to daily posting of KLCI PE ratio.

Please note that P/E here of 15.3x is based on FORWARD/Forecast PE on 2012 earnings. For actual PE, please refer to daily posting of KLCI PE ratio.

Sunday, February 12, 2012

Friday, February 10, 2012

Wednesday, February 8, 2012

Tuesday, February 7, 2012

FTSE Bursa Malaysia (KLSE) KLCI 10-year P/E Multiple Chart as at 27-Jan-2012

Thursday, February 2, 2012

Wednesday, February 1, 2012

The Boom and Bust of KLSE / KLCI

A financial instructor once told me, 'If you could catch the few bust n booms of the economic cycle in your lifetime, you will be rich'.

Problem is, it is very difficult if not impossible to determine the peak n trough of the cycle. Which explains why the middle-aged financial instructor is still conducting classes and not enjoying a work-free retirement.

I do not attempt to determine the peaks n troughs of the market. However, I aspire to do better than dollar-cost averaging and buying the index. I do my homework; study the market, the global economy, individual stocks & abit of technical analysis.

At this point of time, everyone is shouting 'The risk of recession is off the table', 'Market has already priced in the worst, grab them at a bargain now before they fly'. Confidence is up, China is growing better than expected, Fed may embark on QE3. Wow, with all the cheerleading, how could one not be excited and jump right back into the stock market 'while the market is still cheap'?

Maybe so for other bourses, but our own Bursa KLSE? If valuation is so cheap, I should be snapping up my favourite counters like a Mega-sale shopper rite? How come I cannot find under-valued blue chips to accumulate? Perhaps *gasp* the market is not cheap at all.

Let's investigate how KLSE fared during times of crisis.

In 1997 Asian Financial Crisis, KLSE crashed big time. From 1200 to 270, a mindbogging 78% drop. No wonder mom n pop swear off stocks forever. Can't get data on the PE, PB nor NTA dated back then.

From Asian Financial Crisis bottom at 270 around mid-1998, it chalked up a gain of 270% to the next top, dotcom.

Before the onslaught of DotCom bubble, KLSE reached 1000 points, which demanded a PE of 27. Bubble popped, KLSE tanked 40% to 600 pts. PE fell to 11.

Then it was all good and KLSE passed 1500 mark, 150% up from dotcom bottom around mid-2001.

11-Jan-2008

KLCI : 1516

PE : 22.85

P/NTA : 3.95

DY : 3.44%

Along came The Great Recession and brought the market down 40%

05-Dec-2008

KLCI : 838

PE : 11.29

P/NTA: 2.2

DY: 6.47%

2 years after the Great Recession, we enjoyed a superb recovery thanks to concerted government effort in flooding the market with liquidity.

KLSE up 86% from the lows of 2008.

22-July-2011

KLCI : 1565

PE: 16.58

P/NTA: 4.14

Then Europe and US scared the s*** out of Mr Market, and we took a tumble, KLSE down 12%.

23-Sept-11

KLCI: 1365

PE: 14.89

P/NTA: 4.16

With today's upbeat sentiment that no one is sinking into a recession and Asia will continue to grow with China leading the pack, KLCI is back with a vengence.

13-Jan-2012

KLCI: 1523

PE: 16.7

P/NTA: 5.15

You call that gloom n doom all priced in?

Once earnings start dropping in the next quarter or so, PE won't be looking so pretty. Global slowdown is a sure thing. The debate now is whether we will muddle through or slip into a recession. Both are not good.

Okay, you may argue that KLCI may go even higher. It is afterall, not at the PE ~20 range yet, and with March Election 'round the corner, KLCI will not be allowed to fall. I totally buy that argument. Perhaps that is precisely why KLCI is so over-priced.

That said, I am still pretty much risk-off as the upside is limited and all the counters I have my eyes on are above PE23 already. Buy VALUE or do nothing.

Problem is, it is very difficult if not impossible to determine the peak n trough of the cycle. Which explains why the middle-aged financial instructor is still conducting classes and not enjoying a work-free retirement.

I do not attempt to determine the peaks n troughs of the market. However, I aspire to do better than dollar-cost averaging and buying the index. I do my homework; study the market, the global economy, individual stocks & abit of technical analysis.

At this point of time, everyone is shouting 'The risk of recession is off the table', 'Market has already priced in the worst, grab them at a bargain now before they fly'. Confidence is up, China is growing better than expected, Fed may embark on QE3. Wow, with all the cheerleading, how could one not be excited and jump right back into the stock market 'while the market is still cheap'?

Maybe so for other bourses, but our own Bursa KLSE? If valuation is so cheap, I should be snapping up my favourite counters like a Mega-sale shopper rite? How come I cannot find under-valued blue chips to accumulate? Perhaps *gasp* the market is not cheap at all.

Let's investigate how KLSE fared during times of crisis.

In 1997 Asian Financial Crisis, KLSE crashed big time. From 1200 to 270, a mindbogging 78% drop. No wonder mom n pop swear off stocks forever. Can't get data on the PE, PB nor NTA dated back then.

From Asian Financial Crisis bottom at 270 around mid-1998, it chalked up a gain of 270% to the next top, dotcom.

Before the onslaught of DotCom bubble, KLSE reached 1000 points, which demanded a PE of 27. Bubble popped, KLSE tanked 40% to 600 pts. PE fell to 11.

Then it was all good and KLSE passed 1500 mark, 150% up from dotcom bottom around mid-2001.

11-Jan-2008

KLCI : 1516

PE : 22.85

P/NTA : 3.95

DY : 3.44%

Along came The Great Recession and brought the market down 40%

05-Dec-2008

KLCI : 838

PE : 11.29

P/NTA: 2.2

DY: 6.47%

2 years after the Great Recession, we enjoyed a superb recovery thanks to concerted government effort in flooding the market with liquidity.

KLSE up 86% from the lows of 2008.

22-July-2011

KLCI : 1565

PE: 16.58

P/NTA: 4.14

Then Europe and US scared the s*** out of Mr Market, and we took a tumble, KLSE down 12%.

23-Sept-11

KLCI: 1365

PE: 14.89

P/NTA: 4.16

With today's upbeat sentiment that no one is sinking into a recession and Asia will continue to grow with China leading the pack, KLCI is back with a vengence.

13-Jan-2012

KLCI: 1523

PE: 16.7

P/NTA: 5.15

You call that gloom n doom all priced in?

Once earnings start dropping in the next quarter or so, PE won't be looking so pretty. Global slowdown is a sure thing. The debate now is whether we will muddle through or slip into a recession. Both are not good.

Okay, you may argue that KLCI may go even higher. It is afterall, not at the PE ~20 range yet, and with March Election 'round the corner, KLCI will not be allowed to fall. I totally buy that argument. Perhaps that is precisely why KLCI is so over-priced.

That said, I am still pretty much risk-off as the upside is limited and all the counters I have my eyes on are above PE23 already. Buy VALUE or do nothing.

Subscribe to:

Posts (Atom)