An Average-Income Earner's determined choice to be Financially Free through Intelligent Investments in Properties, Shares, ETFs, Options and Businesses.

Monday, January 30, 2012

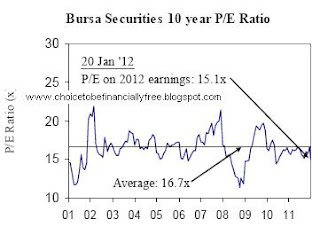

KLSE / KLCI 10-year P/E Multiple Chart as at 20 Jan 2012

Source: Public Mutual

Note that P/E shown in the chart is 2012 forward/forecast PE. Current KLCI PE is at 16.6

Sunday, January 29, 2012

KLSE / KLCI 10-year P/E Multiple Chart as at 16-Jan-2012

Please note that the P/E is on 2012 earnings, which means Forward/Forecast Earnings. Current KLCI PE is 16+

Thursday, January 26, 2012

Happy Chinese New Year 2012

Updates shall resume tomorrow. Sorry for the hiatus. Too caught up with the celebration. I should use Blogger Mobile more.

I have been collecting info on the boom and bust of KLSE. The major events that shakes the market; such as Asian Financial Crisis 1997, DotCom Bubble 2000 & The Great Recession 2008, and its effects on KLSE valuation. I'm furnishing the chart the best i could. I may post it if I feel it's good enough or if anyone wishes to see it.

Gong Hei Fatt Choy. Have a joyful and prosperous year y'all.

I have been collecting info on the boom and bust of KLSE. The major events that shakes the market; such as Asian Financial Crisis 1997, DotCom Bubble 2000 & The Great Recession 2008, and its effects on KLSE valuation. I'm furnishing the chart the best i could. I may post it if I feel it's good enough or if anyone wishes to see it.

Gong Hei Fatt Choy. Have a joyful and prosperous year y'all.

Thursday, January 19, 2012

Wednesday, January 18, 2012

KLSE FTSE Bursa Malaysia KLCI P/E as at 18-Jan-2012

I've decided to compile the KLCI PE data in a spreedsheet. This way, I can generate the graph of KLCI PE easily when the data collection becomes substantial.

Monday, January 16, 2012

Seminar Review : Investment Mastery by Terrence Tan

I attended this seminar last week. I didn't have high expectations as ChartNexus seminars failed to impress. I only hoped that the presenter won't mumble as much.

The seminar started a little late; my pet peeve. Cause I usually arrive early for events and a delay means I gotta hang around inhaling more second hand smoke. At 7:45pm, the gates, I mean doors were opened and we were greeted by Terence himself. A TALL lanky guy with a big smile.

I heaved a sigh of relief when he started talking. No mumbles. Charismatic speaker. Intiguing contents.

"How can we obtain an investment income of US$1000 Weekly income in 2012? "

My squinty eyes widened when he flashed this slide. Fast forward to the time of writing, I calculated that in order to achieve this, I need to have a US$20,000 capital. Let's not be greedy. US$250 per week is sufficient for me; so US$5000 capital.

90% of his grads started this investment strategy for real immediately after the program.

The targetted return is 2-5% every week. Which translates to at least 100% - 250% annual gain. Friggin impressive if you ask me.

Next thing I know, he was talking about property investment. The more asset you own, the richer you are. And receive monthly income via rental.

Stock can be an asset as well. We all know that Warren Buffet became one of the richest man in the world through accumulating shares in the market. But what most of us don't know is that he rents them out. And his stock rental income is more than the dividend he collects.

We can also adopt the same strategy and rent out our stocks.

What you need to know

1. Keep things simple

Know which stocks to buy today. These 3 stocks will never go bankrupt or become penny stocks.

2. Buy these 3 stocks now with just US$500. This is the minimum. Any lesser, Terrence cannot help.

3. Generate Extra Income from these 3 stocks

4. Get paid every week from these 3 stocks

Collect a rental of 2-5% every WEEK on the average.

What is the Secret

1. Buy Low n Sell High

2. Sell High n Buy back low

At this point, Terrence started laughing because the audience are rolling their eyes. Silly cruel joke.

Ok, so the REAL secret.

Buy stocks of GREAT companies and rent them out.

How to rent out stocks?

Sell the options of that stock.

What are Options?

Options are simply insurance policies that are sold in the stock market.

Options give you the Right to Buy or Sell Stocks at a Fixed price and a Fixed date.

Fact:

90% Options expire worthless.

Buyers of options lose 90% of the time. Never ever buy another option!

Which means options seller win 90% of the time.

It's hard enough to be right on the direction of the stock. With option, the level of difficulty goes up a thousand fold because the stock has to reach your target price within a certain time frame.

If you got the direction wrong, you lose.

If you get the direction right but the stock doesnt reach your target price, you lose.

If you got the direction right AND the stock reaches your target price but not fast enough, the options expire before target is met, you lose.

Stock price has only 3 directions. UP, Down and Nowhere.

As option seller, we win when stock goes against the bet (up/down) AND we win even when the stock goes nowhere!

So be an option seller!

The seminar started a little late; my pet peeve. Cause I usually arrive early for events and a delay means I gotta hang around inhaling more second hand smoke. At 7:45pm, the gates, I mean doors were opened and we were greeted by Terence himself. A TALL lanky guy with a big smile.

I heaved a sigh of relief when he started talking. No mumbles. Charismatic speaker. Intiguing contents.

"How can we obtain an investment income of US$1000 Weekly income in 2012? "

My squinty eyes widened when he flashed this slide. Fast forward to the time of writing, I calculated that in order to achieve this, I need to have a US$20,000 capital. Let's not be greedy. US$250 per week is sufficient for me; so US$5000 capital.

90% of his grads started this investment strategy for real immediately after the program.

The targetted return is 2-5% every week. Which translates to at least 100% - 250% annual gain. Friggin impressive if you ask me.

Next thing I know, he was talking about property investment. The more asset you own, the richer you are. And receive monthly income via rental.

Stock can be an asset as well. We all know that Warren Buffet became one of the richest man in the world through accumulating shares in the market. But what most of us don't know is that he rents them out. And his stock rental income is more than the dividend he collects.

We can also adopt the same strategy and rent out our stocks.

What you need to know

1. Keep things simple

Know which stocks to buy today. These 3 stocks will never go bankrupt or become penny stocks.

2. Buy these 3 stocks now with just US$500. This is the minimum. Any lesser, Terrence cannot help.

3. Generate Extra Income from these 3 stocks

4. Get paid every week from these 3 stocks

Collect a rental of 2-5% every WEEK on the average.

What is the Secret

1. Buy Low n Sell High

2. Sell High n Buy back low

At this point, Terrence started laughing because the audience are rolling their eyes. Silly cruel joke.

Ok, so the REAL secret.

Buy stocks of GREAT companies and rent them out.

How to rent out stocks?

Sell the options of that stock.

What are Options?

Options are simply insurance policies that are sold in the stock market.

Options give you the Right to Buy or Sell Stocks at a Fixed price and a Fixed date.

Fact:

90% Options expire worthless.

Buyers of options lose 90% of the time. Never ever buy another option!

Which means options seller win 90% of the time.

It's hard enough to be right on the direction of the stock. With option, the level of difficulty goes up a thousand fold because the stock has to reach your target price within a certain time frame.

If you got the direction wrong, you lose.

If you get the direction right but the stock doesnt reach your target price, you lose.

If you got the direction right AND the stock reaches your target price but not fast enough, the options expire before target is met, you lose.

Stock price has only 3 directions. UP, Down and Nowhere.

As option seller, we win when stock goes against the bet (up/down) AND we win even when the stock goes nowhere!

So be an option seller!

KLSE FTSE Bursa Malaysia KLCI P/E as at 16-Jan-2012

At Closing on 16-Jan-2012

KLCI Index : 1509.06

P/E Ratio : 16.2074

KLCI Index : 1509.06

P/E Ratio : 16.2074

Sunday, January 15, 2012

FTSE Bursa Malaysia (KLSE) KLCI 10-year P/E Multiple Chart as at 06-Jan-2012

KLSE FTSE Bursa Malaysia KLCI P/E as at 13-Jan-2012

At Closing on 13-Jan-2012

KLCI Index : 1523.07

P/E Ratio : 16.3578

KLCI Index : 1523.07

P/E Ratio : 16.3578

KLSE FTSE Bursa Malaysia KLCI P/E as at 12-Jan-2012

At Closing on 12-Jan-2012

KLCI Index : 1525.56

P/E Ratio : 16.3846

KLCI Index : 1525.56

P/E Ratio : 16.3846

Wednesday, January 11, 2012

KLSE FTSE Bursa Malaysia KLCI P/E as at 11-Jan-2012

At Closing on 11-Jan-2012

KLCI Index : 1522.29

P/E Ratio : 16.3495

KLCI Index : 1522.29

P/E Ratio : 16.3495

Tuesday, January 10, 2012

KLSE FTSE Bursa Malaysia KLCI P/E as at 10-Jan-2012

At Closing on 10-Jan-2012

KLCI Index : 1521.99

P/E Ratio : 16.3462

KLCI Index : 1521.99

P/E Ratio : 16.3462

Monday, January 9, 2012

Petronas Dagangan - The Story

Petronas Dagangan is the principal domestic marketing arm of Petroliam Nasional Berhad (PETRONAS) for downstream petroleum products. Think Petronas gas stations,Kedai Mesra and the cooking gas cylinders in the kitchen.

Retail (50%) and Commercial business(31%) contributes 81% of Petdag's net margin.

Retail is the key business, contributing almost 50% of group's net margin.

Retail market share maintained at 32%.

995 service stations. 617 Kedai Mesra. 22 new service stations in FYE2011.

Plans to continue expanding service station network as it aims to take market leadership.

Non-fuel income, Kedai Mesra, increased 14% from last year.

Commercial Business’market leadership of more than 60%. Contributes 31% of Petdag's net margin.

Commercial Business sales volume grew 3.8%. Prominent in aviation sector.

Dominant market share of 70% at KLIA and other major airports.

Market leader in LPG (50.7%)

Lubricant market share 22%.

Sale volume improved by 9%.Partnership deals with Proton Edar, Naza Chevrolet, Cycle & Carriage and Perodua to supply lubricants.

Growth in FYE2011

Retail- Maintain

Commercial -3.8%

Lubricants - 9%

LPG - 2%

Management has the ambition to take market leadership in 2-5 years time.

How?

Improve service in retail arm.

For commercial business, concentrating on new opportunities coming out of the economic development corridors under the 10th Malaysia Plan and the government’s Economic Transformation Programmes (ETPs).

For LPG, which is matured market, Petdag will include innovative marketing and tighter cost control.

Petdag took a hit in 2009, effects from the Great Recession; earnings declined as much as 12%. The oncoming global recession 2012 doesn't bode well with this stock. The commercial chunk contributes quite significantly to Petdag's bottomline. Aviation isn't gonna take off to high grounds in such gloomy economy. The best outcome is very slow growth in the US. Recession is already a sure thing in Europe.

Moreover, Petdag at 17.20 is rather over-valued. It factors in high growth rate which I don't think is achievable under such unfavorable economic conditions.

The growth story by the management doesn't even jump at you. Nothing major happening. Just improving services and operations.

Overall, I like Petdag, but not at its current valuation.

Update, 30-Jan-2012

http://www.theedgemalaysia.com/highlights/200078-2012-ceo-outlook-series-pdb-to-boost-presence-beyond-msia.html

In 2012, Petdag will explore growth beyond Malaysia, starting with regional opportunities that will complement commercial goals.

Retail (50%) and Commercial business(31%) contributes 81% of Petdag's net margin.

Retail is the key business, contributing almost 50% of group's net margin.

Retail market share maintained at 32%.

995 service stations. 617 Kedai Mesra. 22 new service stations in FYE2011.

Plans to continue expanding service station network as it aims to take market leadership.

Non-fuel income, Kedai Mesra, increased 14% from last year.

Commercial Business’market leadership of more than 60%. Contributes 31% of Petdag's net margin.

Commercial Business sales volume grew 3.8%. Prominent in aviation sector.

Dominant market share of 70% at KLIA and other major airports.

Market leader in LPG (50.7%)

Lubricant market share 22%.

Sale volume improved by 9%.Partnership deals with Proton Edar, Naza Chevrolet, Cycle & Carriage and Perodua to supply lubricants.

Growth in FYE2011

Retail- Maintain

Commercial -3.8%

Lubricants - 9%

LPG - 2%

Management has the ambition to take market leadership in 2-5 years time.

How?

Improve service in retail arm.

For commercial business, concentrating on new opportunities coming out of the economic development corridors under the 10th Malaysia Plan and the government’s Economic Transformation Programmes (ETPs).

For LPG, which is matured market, Petdag will include innovative marketing and tighter cost control.

Petdag took a hit in 2009, effects from the Great Recession; earnings declined as much as 12%. The oncoming global recession 2012 doesn't bode well with this stock. The commercial chunk contributes quite significantly to Petdag's bottomline. Aviation isn't gonna take off to high grounds in such gloomy economy. The best outcome is very slow growth in the US. Recession is already a sure thing in Europe.

Moreover, Petdag at 17.20 is rather over-valued. It factors in high growth rate which I don't think is achievable under such unfavorable economic conditions.

The growth story by the management doesn't even jump at you. Nothing major happening. Just improving services and operations.

Overall, I like Petdag, but not at its current valuation.

Update, 30-Jan-2012

http://www.theedgemalaysia.com/highlights/200078-2012-ceo-outlook-series-pdb-to-boost-presence-beyond-msia.html

In 2012, Petdag will explore growth beyond Malaysia, starting with regional opportunities that will complement commercial goals.

KLSE FTSE Bursa Malaysia KLCI P/E as at 09-Jan-2012

At Closing on 09-Jan-2012

KLCI Index : 1521.73

P/E Ratio : 16.3434

KLCI Index : 1521.73

P/E Ratio : 16.3434

Sunday, January 8, 2012

KLSE FTSE Bursa Malaysia KLCI P/E as at 06-Jan-2012

At Closing on 06-Jan-2012

KLCI Index : 1514.13

P/E Ratio : 16.2618

KLCI Index : 1514.13

P/E Ratio : 16.2618

Thursday, January 5, 2012

KLSE FTSE Bursa Malaysia KLCI P/E as at 05-Jan-2012

At Closing on 05-Jan-2012

KLCI Index : 1514.43

P/E Ratio : 16.265

KLCI Index : 1514.43

P/E Ratio : 16.265

Wednesday, January 4, 2012

KLSE FTSE Bursa Malaysia KLCI P/E as at 04-Jan-2012

At Closing on 04-Jan-2012

KLCI Index : 1504.22

P/E Ratio : 16.1554

KLCI Index : 1504.22

P/E Ratio : 16.1554

Tuesday, January 3, 2012

KLSE FTSE Bursa Malaysia KLCI P/E as at 03-Jan-2012

At Closing on 03-Jan-2012

KLCI Index : 1513.54

P/E Ratio : 16.2555

KLCI Index : 1513.54

P/E Ratio : 16.2555

Monday, January 2, 2012

FTSE Bursa Malaysia (KLSE) KLCI 10-year P/E Multiple Chart as at 16-Dec-2011

Brief Message

Sorry for the hiatus. I've been out of action for the past one week. The turn of a new year hasn't been kind to me. Now that I am better and headed towards recovery, I hope the New Year brings good health, most of all.

2011 has been a great year and 2012 will be nothing less than fantastic.

2011 has been a great year and 2012 will be nothing less than fantastic.

Subscribe to:

Comments (Atom)