At Closing on 24-November-2011

KLCI Index : 1447.99

P/E Ratio : 15.8353

An Average-Income Earner's determined choice to be Financially Free through Intelligent Investments in Properties, Shares, ETFs, Options and Businesses.

Thursday, November 24, 2011

Wednesday, November 23, 2011

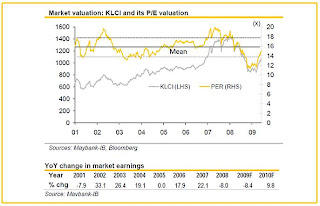

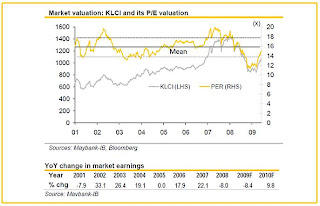

Graph of KLSE/Bursa KLCI PE

The market PE at current is about 16. And the average PE of KLCI is about 16. The market is neither undervalue nor overvalued at this point of time. But what if we fall into a recession next year? How does KLCI PE look like in times of recession?

I've searched high and low for the historical graph of KLCI PE for a long time and found nothing. I'm looking for something similar to this, the S&P 500 PE Ratio graph:

Source: http://www.multpl.com/

I rejoiced when I chanced upon this report from Maybank-IB, which provided a graph of KLCI PE. However this report is rather outdated. And I just can't find a similar recent report from Maybank-IB.

Source:Maybank-IB

Then, Public Mutual sent me this in its newsletter. Here is the most recent Bursa KLCI PE graph in its 11-Nov-2011 newsletter.

Source: Public Mutual

The information in both sources are quite identical. Average PE of FTSE Bursa Malaysia KLCI is about 16x.

During the 2008-2009 global financial crisis, the PE fell to ~11. Just to illustrate how valuation of securities fall in tandem with the confidence of the general public in the share market.

The PE of KLCI tells us that Malaysians today are still quite confident of the market. Perhaps influenced by the impending general election and the promises of ETP's effectiveness.

I do not see any reason to enter the market at this point. The upside is limited but the downside is too huge to stomach.

I've searched high and low for the historical graph of KLCI PE for a long time and found nothing. I'm looking for something similar to this, the S&P 500 PE Ratio graph:

Source: http://www.multpl.com/

I rejoiced when I chanced upon this report from Maybank-IB, which provided a graph of KLCI PE. However this report is rather outdated. And I just can't find a similar recent report from Maybank-IB.

Source:Maybank-IB

Then, Public Mutual sent me this in its newsletter. Here is the most recent Bursa KLCI PE graph in its 11-Nov-2011 newsletter.

Source: Public Mutual

The information in both sources are quite identical. Average PE of FTSE Bursa Malaysia KLCI is about 16x.

During the 2008-2009 global financial crisis, the PE fell to ~11. Just to illustrate how valuation of securities fall in tandem with the confidence of the general public in the share market.

The PE of KLCI tells us that Malaysians today are still quite confident of the market. Perhaps influenced by the impending general election and the promises of ETP's effectiveness.

I do not see any reason to enter the market at this point. The upside is limited but the downside is too huge to stomach.

KLSE Bursa KLCI PE Ratio

At Closing on 23-November-2011

KLCI Index : 1433.17

P/E Ratio : 15.6976

KLCI Index : 1433.17

P/E Ratio : 15.6976

Tuesday, November 22, 2011

Guinness Anchor Berhad, GAB - Fundamental Analysis

In GAB The Story, I ended with the remark steady growth but nothing explosive. To illustrate this statement, I charted out the EPS(Earnings per share) and Revenue of GAB from 2006-2011. FYI, financial year end for GAB is 30-June.

So preditable that I can almost draw a straight line into future projection. Notice how the 2008 global financial crisis didn't hamper earnings.

Profit margin at 31% is decent. Carlsberg is at 30-ish% as well.

Operating expenses for SGA (Selling, general & administrative) rose 30% from previous year. At 49% of gross profit, SGA expense is still very alright. Just gotta keep an eye on the yearly increment.

GAB does not need to incur much spending on CAPEX (Capital expenditure). 31 million in 2011, which translate to 17.5% of net earnings. Depreciation is corresspondingly low.

GAB has a cash pile of 178 million and ZERO borrowings.

Due to its zero borrowings, I will not go into gearing ratios. Cos they will be err, zilch.

So, is GAB a cash cow? Lets look at its FCF (free cash flow). Free cash flow is Operating cash flow minus capex. FCF yield in 2011 is 5.36%, an increase of 40% from previous year. Nice.

ROE (Return on Equity) in 2011 is 35%, compared to peer Carlsberg 23% (FY 2010). Take caution when reading into this ratio, as it is affected by the debt level. Highly geared companies can have higher ROE. ROE is meaningful here as GAB has zero gearing.

So far, GAB looks pretty awesome doesn't it? It is obviously a solid and financially sound company. I'd love to own shares of it. But the big question, what is the right price to pay? I should be buying at fair value, or even better, when it is undervalued.

Let's dive into price ratios.

The most popular of all ratios, PE (Price over Earnings) Ratio.

On 22 Nov 2011, PE ratio of GAB is 17.69.

There is only 1 other comparable listed brewery, Carlsberg. PE of 16.67

Growth rate of GAB over 5 years is 7.19%

PEG (PE over growth) ratio is therefore 2.46.

More on PEG, read my previous post PEG Ratio

At the current price of RM10+, GAB is rather overpriced, in my opinion.

What is the fair price for GAB? I use Discounted Cash Flow (DCF) model. But seriously, don't rely too much on it as it has many variables. You know what they say, garbage in, garbage out. I adjust the calculations such as discount factor to my own comfort level. And I am conservative. Throw in all the numbers, and DCF regurgitates RM7.80. That is my number.

There is an excellent tutorial on DCF calculation on Investopedia. Comes with example to guide you through the whole process. If that's too much trouble, there are DCF calculators (usually in spreadsheets) that you can download from the Net.

In summary, I'd buy GAB for the long term, but not at this price. I'm anticipating a recession. Read Macro Outlook 15-Nov-2011. My chance will come.

So preditable that I can almost draw a straight line into future projection. Notice how the 2008 global financial crisis didn't hamper earnings.

Profit margin at 31% is decent. Carlsberg is at 30-ish% as well.

Operating expenses for SGA (Selling, general & administrative) rose 30% from previous year. At 49% of gross profit, SGA expense is still very alright. Just gotta keep an eye on the yearly increment.

GAB does not need to incur much spending on CAPEX (Capital expenditure). 31 million in 2011, which translate to 17.5% of net earnings. Depreciation is corresspondingly low.

GAB has a cash pile of 178 million and ZERO borrowings.

Due to its zero borrowings, I will not go into gearing ratios. Cos they will be err, zilch.

So, is GAB a cash cow? Lets look at its FCF (free cash flow). Free cash flow is Operating cash flow minus capex. FCF yield in 2011 is 5.36%, an increase of 40% from previous year. Nice.

ROE (Return on Equity) in 2011 is 35%, compared to peer Carlsberg 23% (FY 2010). Take caution when reading into this ratio, as it is affected by the debt level. Highly geared companies can have higher ROE. ROE is meaningful here as GAB has zero gearing.

So far, GAB looks pretty awesome doesn't it? It is obviously a solid and financially sound company. I'd love to own shares of it. But the big question, what is the right price to pay? I should be buying at fair value, or even better, when it is undervalued.

Let's dive into price ratios.

The most popular of all ratios, PE (Price over Earnings) Ratio.

On 22 Nov 2011, PE ratio of GAB is 17.69.

There is only 1 other comparable listed brewery, Carlsberg. PE of 16.67

Growth rate of GAB over 5 years is 7.19%

PEG (PE over growth) ratio is therefore 2.46.

More on PEG, read my previous post PEG Ratio

At the current price of RM10+, GAB is rather overpriced, in my opinion.

What is the fair price for GAB? I use Discounted Cash Flow (DCF) model. But seriously, don't rely too much on it as it has many variables. You know what they say, garbage in, garbage out. I adjust the calculations such as discount factor to my own comfort level. And I am conservative. Throw in all the numbers, and DCF regurgitates RM7.80. That is my number.

There is an excellent tutorial on DCF calculation on Investopedia. Comes with example to guide you through the whole process. If that's too much trouble, there are DCF calculators (usually in spreadsheets) that you can download from the Net.

In summary, I'd buy GAB for the long term, but not at this price. I'm anticipating a recession. Read Macro Outlook 15-Nov-2011. My chance will come.

Labels:

Financial Ratio,

Fundamental Analysis,

GAB,

Stock Picking

Bursa/KLSE KLCI PE Ratio

At Closing on 22-November-2011

KLCI Index : 1437.99

P/E Ratio : 15.6181

KLCI Index : 1437.99

P/E Ratio : 15.6181

Monday, November 21, 2011

Guinness Anchor Berhad, GAB - The Story

GAB brews and sells beer, as simple as that. Its line up by category.

Beer

Tiger

Anchor

Heineken

Stout

Guinness

Premium Beer

Kilkenny

Paulaner

Strong bow

Sol

Malt & Shandy

Malta

Anglia

Tiger, Guinness, Heineken, Anchor, Kilkenney and Malta are brewed locally while Strongbow, Paulaner and Sol are imported.

The one closest to my heart, and gut, is Paulaner. Whoops, off topic.

GAB Bhd has presence only in Malaysia. No participation in regional markets via subsidiaries, unlike Carlsberg's model. However, GAB has the largest market share in Malt Liquor Market (MLM) locally at roughly 59%.

GAB is a dividend share, dishing out close to 90% of nett profit as dividends to shareholders. Dividend yield is 5% for FY2010 and FY2011. Better than FD at 3.x%. The share price is also doing extremely well. CAGR from 2007-2011 is 14.5%. If I had bought GAB in 2007 at 5.90 and held it till 2011, I would have gotten returns of ~19.5% annually. Fantastic.

GAB weathers recession really well. A strong defensive stock that was not affected by the 2008 great recession, in terms of revenue and profit.

Guinness Stout rules over Royal Stout, no contest about that. Volume of Guinness stout rose a mid-single digit in FY2011 but pubs/bars sales rose 20%, possibly indicating the younger crowd developing a taste for stout, an under-tapped segment.

In FY2011, Tiger volume rose by 10% and Heineken in mid teens.

GAB's new launches are Newcastle Brown Ale, an imported beer and new variant of Anglia Shandy, Orange and Grape.

Caveats

Malt Liquor Market (MLM) in Msia has not grown in the past 14 years. Consumption per capita actually decreased by CAGR -2.3% in the period from 2004-2009.Perhaps inline with the decrease of non-muslims in Msia.

Beer is slapped with very high excise duty. Highest in the region and 2nd highest in the world! We escaped a hike in 2011 but no guarantees for 2012. GAB’s percentage of excise duties to sales revenue is 50.4%

Gross profit margin has been flattish for the past 7 years.

Beer

Tiger

Anchor

Heineken

Stout

Guinness

Premium Beer

Kilkenny

Paulaner

Strong bow

Sol

Malt & Shandy

Malta

Anglia

Tiger, Guinness, Heineken, Anchor, Kilkenney and Malta are brewed locally while Strongbow, Paulaner and Sol are imported.

The one closest to my heart, and gut, is Paulaner. Whoops, off topic.

GAB Bhd has presence only in Malaysia. No participation in regional markets via subsidiaries, unlike Carlsberg's model. However, GAB has the largest market share in Malt Liquor Market (MLM) locally at roughly 59%.

GAB is a dividend share, dishing out close to 90% of nett profit as dividends to shareholders. Dividend yield is 5% for FY2010 and FY2011. Better than FD at 3.x%. The share price is also doing extremely well. CAGR from 2007-2011 is 14.5%. If I had bought GAB in 2007 at 5.90 and held it till 2011, I would have gotten returns of ~19.5% annually. Fantastic.

GAB weathers recession really well. A strong defensive stock that was not affected by the 2008 great recession, in terms of revenue and profit.

Guinness Stout rules over Royal Stout, no contest about that. Volume of Guinness stout rose a mid-single digit in FY2011 but pubs/bars sales rose 20%, possibly indicating the younger crowd developing a taste for stout, an under-tapped segment.

In FY2011, Tiger volume rose by 10% and Heineken in mid teens.

GAB's new launches are Newcastle Brown Ale, an imported beer and new variant of Anglia Shandy, Orange and Grape.

Caveats

Malt Liquor Market (MLM) in Msia has not grown in the past 14 years. Consumption per capita actually decreased by CAGR -2.3% in the period from 2004-2009.Perhaps inline with the decrease of non-muslims in Msia.

Beer is slapped with very high excise duty. Highest in the region and 2nd highest in the world! We escaped a hike in 2011 but no guarantees for 2012. GAB’s percentage of excise duties to sales revenue is 50.4%

Gross profit margin has been flattish for the past 7 years.

Source: GAB Annual Report Year 2011

Wheat barley, key ingredient in brewing beer, is forecasted to rise 30-40% in Year 2012. Aluminium for canning is also expected to rise. Raw material and packaging costs accounts for 9.95% of revenue.GAB’s ties with Asia Pacific Brewery (APB), GAB's parent company, provide access to bulk purchases of key ingredients such as aluminium and wheat. Therefore, moderating some of the volatility in commodities. On this point, I'm not too worried as GAB has always been able to pass the cost down to consumers. Its most recent price hike was in 2011.

In Summary

GAB is a market leader, approximately 59% of market share. It has strong branding and loyal following. Consumers are unlikely to switch to a slightly cheaper product, unlike products like toilet-rolls. As a stock, it is low beta, dividend-paying stock and enjoys a steady appreciation in share price. Its biggest competitor is ofcourse, Carlsberg. In the premium beer segment, Starker by the 3rd player after GAB and Carlsberg puts up a good fight with OverTime pubs popping up like mushrooms all over Klang Valley.

GAB is good in many areas, but I search hard for a growth catalyst and fail to find one. I expect slow and steady growth, but nothing explosive.

Wheat barley, key ingredient in brewing beer, is forecasted to rise 30-40% in Year 2012. Aluminium for canning is also expected to rise. Raw material and packaging costs accounts for 9.95% of revenue.GAB’s ties with Asia Pacific Brewery (APB), GAB's parent company, provide access to bulk purchases of key ingredients such as aluminium and wheat. Therefore, moderating some of the volatility in commodities. On this point, I'm not too worried as GAB has always been able to pass the cost down to consumers. Its most recent price hike was in 2011.

In Summary

GAB is a market leader, approximately 59% of market share. It has strong branding and loyal following. Consumers are unlikely to switch to a slightly cheaper product, unlike products like toilet-rolls. As a stock, it is low beta, dividend-paying stock and enjoys a steady appreciation in share price. Its biggest competitor is ofcourse, Carlsberg. In the premium beer segment, Starker by the 3rd player after GAB and Carlsberg puts up a good fight with OverTime pubs popping up like mushrooms all over Klang Valley.

GAB is good in many areas, but I search hard for a growth catalyst and fail to find one. I expect slow and steady growth, but nothing explosive.

KLSE KLCI PE Ratio

At Closing on 21-November-2011

KLCI Index : 1434.08

P/E Ratio : 15.6209

KLCI Index : 1434.08

P/E Ratio : 15.6209

Subscribe to:

Posts (Atom)